The gory tales of loan apps and the way they harass defaulters that are unable to pay is alarming. Many people have gone into never-ending debts, just by borrowing a little sum of money. Interest rates for defaulters are ridiculously high, sending borrowers deeper into the sea of debts. They even go as far as calling the defaulter’s contacts and sending them incriminating messages just to prompt them to pay back. Some people that have been into this regret their actions and wish they could take back the hands of time.

One of such people is Mr. Paul Maduka, who is a family man. He had borrowed money from one of the online apps to invest in his business, hoping that he would be able to pay back by the due date. Unfortunately for him, he couldn’t pay as at when due. The loan app agents went all out for him, as they called and sent incriminating messages to his contacts calling him a criminal, fraudster amongst others. Mr. Paul Maduka has since been running from pillar to post to gather money to pay back the loan. According to him, he has been depressed and even thought of committing suicide.

There are many Nigerians like Mr. Paul Maduka, who are held captives in the shackles of debts because of these loan agents. Some even go as far as sending out obituary pictures. A 25-year-old woman, Cynthia, said she resorted to changing her phone number to have peace of mind. Although, they still sent messages to her contacts.

What does this tell you?

- You should know the terms and conditions before accepting a loan.

- You should know and be sure of the interest rate before applying for a loan.

- You should be aware of what happens in cases of default. Whether there are default interests and how much it is.

- Make your research on the loan agent you intend to apply from.

- Endeavor to borrow what you can payback.

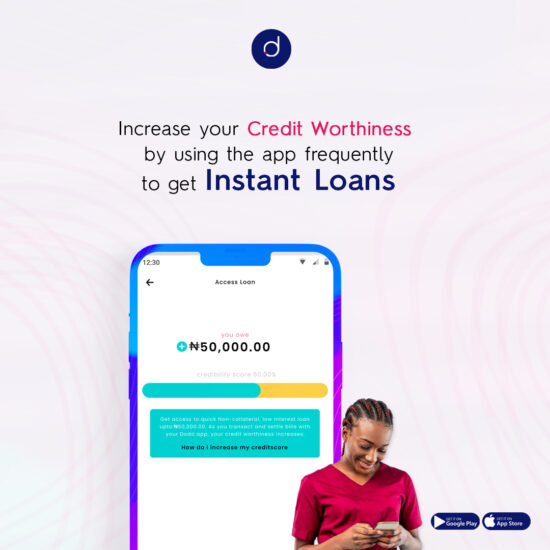

Why is dodopay quick loan better?

- Low-interest rates: interests run as low as 0.25% daily.

- No harassment: Dodopay gives you as long as 90 days to pay back your loan. You don’t have to worry about unnecessary calls or messages.

- Flexible repayment plan: you can decide to pay back little by little within these 90 days or pay at once by the end of your due date.

All you need to do is to be a loyal customer. Use the dodopay app regularly to qualify for a quick loan.

Closing thoughts,

Borrowing doesn’t have to come with an unpleasant experience. Take loans from only trusted and reliable apps to avoid embarrassment. Dodopay is your surest bet.