We have probably heard this saving topic a million times, and we begin to wonder when it will stop? Make person enjoy life as e suppose be, some would say. In as much as it is good to enjoy life and all the good things that come with it, the importance of saving cannot be over-emphasized. Dododay provides a savings feature that makes saving achievable and easy, along with sweet benefits.

What is this saving feature?

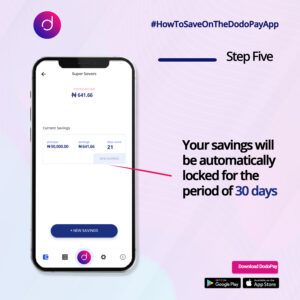

The saving feature on the dodopay app is called Supersavers. It is a feature that helps one to be disciplined with their savings. Users have the option of creating multiple savings to help meet goals for different needs. Talking about discipline, some people are the save and spend kind of people i.e. one minute they are saving, the next minute they are spending it. They do not always meet up with any savings goal because they end up using up the money before the appointed time. But with this saving feature, discipline is considered as funds are automatically locked for at least 30 days before they are accessed. The supersavers option also gives you 22% ROI annually on your savings. Here, it does not feel like you are saving but investing and getting cool ROI on your money. So where would you rather save; the bank or dodopay?

What is in it for you?

There are lots of benefits which you get from saving with dodopay which includes:

- 22% interest per annum on your savings.

- With the dodopay’s super savers option, there is no limit to your savings.

- You can create multiple savings goals; save in different sections to meet distinct goals.

- Your funds are automatically locked for at least 30 days to encourage discipline and make sure you are saving.

- You get accountability because every day, you see your interest accruing on your savings platform.

Getting started- Creating your savings account.

You’ve probably read all the financial goodies the supersavers option has to offer, and you want to create a savings account. These are the steps you should follow:

- Download the app, create an account, and get verified. see dodopay and BVN wahala

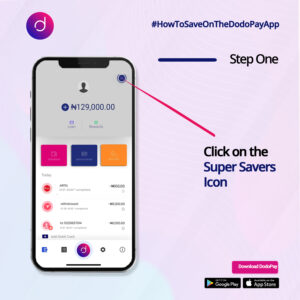

- Click on the top right button on the home screen.

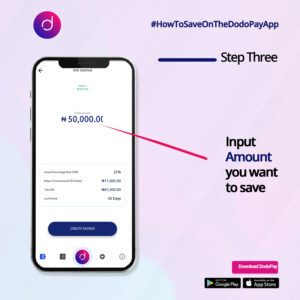

- Type in the amount you want to save (you must have funded your dodo wallet). You will also see the annual ROI you will be earning.

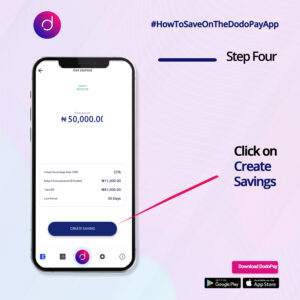

- Click create savings- a saving account will be created for you automatically.

- You can also create multiple saving accounts for different goals.

Conclusion

It’s not too late to start saving on the right platform. This way you are sure your money is safe and yielding enough returns. Visit the dodopay website to download the app and get started.