Some people automatically see people who spend money based on budgets as stingy. While it may seem that way because these people usually think before spending, it is better to be the one who plans before expenses than to be the one who occasionally incurs debt due to overspending and zero planning. Creating a budget does not automatically mean deprivation of the good things of life. The good thing about creating a budget is that you can add all the good and flashy stuff you want to do or buy as far as it is all within your income.

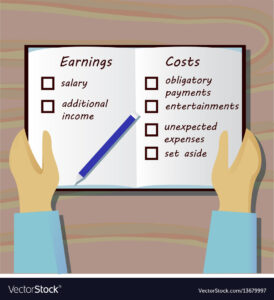

What is a budget?

A budget is a money management tool that helps in planning expenses such that the money caters efficiently to our needs. A budget could be modified monthly, quarterly, or yearly depending on the income flow. A typical budget is divided into sections which include needs, savings or investments, and wants. The total expenses for the month are classified into these sections. Generally, budgets do not come in a particular pattern or structure. It can be customized to suit your needs. The end goal is that you are catering to your needs ahead of your wants.

Steps to creating a budget

Creating a budget involves the prioritization of needs from the highest to the lowest. For example, you might want to pick settling electricity bills over, paying for a subscription to your cable TV, or buying foodstuff over eating out because obviously, it is economical. These are step-by-step procedures to creating a budget:

Know financial goals

Firstly, you need to understand why you want to create a budget. What are the goals you plan to achieve by creating a budget? Of course, it is a tool to help you manage money wisely, but what else is the motivation. Are you trying to improve your saving habit or trying to pay off debts? All these things put in place will help you be faithful to your budget in the long run.

Write down monthly expenses.

You have noted your financial goals and what you hope to achieve in the long run. The next step is to write down all your expenses for the month. Expenses include fixed expenses-rent, periodic expenses-bills, variable expenses- enjoyment. Estimate the total of all expenses in a month. It should be less than or equal to the total income.

Cut unnecessary expenses

By now, you should know that if the expenses are more than your income, then you are wrong. It is time to cut down those unnecessary expenses. Prioritize prime things, and cross out those things that will not have any significant effect if you do not have them. I might decide to leave out the option of buying an extra heel because I already have heels that I can use.

Have emergency funds

While writing down your expenses, you should also remember to add emergency funds. These are funds that come in handy during an emergency or unexpected cases. It should be the top priority when creating your budget.

Needs and wants

After writing down all expenses for the month, it is crucial to categorize these expenses into needs and wants. Needs here refer to those things that are important to your survival. For example, a house is a need because you need a roof under your head. Wants are those things that are not important to our survival. Going to the movies or hanging out with friends are examples of wants. You will need to be honest to yourself at this point because you might think that subscribing to your cable TV is a need but is it?

Fun money

Creating a budget does not mean that there cannot be room for enjoyment. The truth is that making a budget without adding money for flexing will be frustrating in the long run. After all, you have to enjoy the money you worked for, no doubt. Putting this in your budget will not make your budget too strict and unpleasant to follow in the long run. Including flexing money in your budget gives the feeling that you can still be on a budget and still enjoy the things of life.

Debts

Including debt allocations in your budget is also prime if you have debts to pay. Having a budget makes sure you can pay off your debts on time and still cater to other needs. If you have different loans, some may advise you to start from the lesser ones and work your way up to the bigger ones as it helps you psychologically. It gives you the feeling that there is progress. Some may also advise that you start from the bigger ones and work your way down to the smaller ones because this helps you settle large debts quickly. It also gives you the feeling that you have crossed a huge hurdle. Either way, these approaches vary with individuals. Do what works for you. See the possible reasons why you keep running into debts.

Sticking to a budget

It is one thing to create a budget and a different ball game sticking to it. It has all happened to us at some point in time when we had to ditch our budgets the minute we get our paycheck because we cannot kill ourselves. But we also agree that it does not always turn out well as we end up managing what is left. Either way, we still have to manage the money at some point, so why not do it from the beginning? Sticking to a budget also requires discipline. These are ways you can effectively stick to a budget:

Budget to zero

It means your income minus your expenses is equal to zero. One of the ways of making sure you will stick to a budget is by allocating all your money to different needs. This way, you can not use money set aside for food to buy data, recharge cards, or those lovely sneakers you saw on Thelma’s feet. Food money is for food, and fuel money is for fuel.

Set realistic goals

Imagine I want to lose weight, and I say that I will only eat garden eggs and drink water all day for the next one week. Would you not laugh at me because it sounds ridiculous?. It would only be a matter of time before hunger comes knocking at the door. By that time, I would have consumed a whole loaf of bread with rice and stew, thereby defeating the purpose of losing weight. It is the same when I say that I will save 90% of my income and use the remaining 10% to sort out my needs. I might carry out that decision in the first month, but I would not keep up in the coming months.

Curtail impulse buying

You are passing by and see this lovely scarf you have always admired. You inquire about the price, and it does not cost a fortune. In truth, it does not cost much because you have the cash to pay for it, fantastic right? or not. Impulse buying is one reason you will not stick to a budget, because you always feel the need to get anything that looks pretty or appealing. Curtail impulsive buying, and your pocket will thank you for it. See how to manage money wisely.

Pay yourself first

This refers to saving first before spending. 20% is the proposed percentage of income to be allocated to saving. To make it easy, it is better to remove savings and apportion the rest of the money to cater to different needs in your budget.

Plan your meals

It is a known fact that buying foodstuff is cheaper than eating out. Also, homemade meals taste better. So remember to budget for foodstuff than opting to eat out. Your pocket will thank you for that as well.

Conclusion

Eventually, creating a budget and sticking to it would be hard especially, if you are the spending type or are not used to it. However, there will always be a first time, and soon you would be on your way to be fully in charge of your finances, telling your finances where to go and not asking where they went. Visit the dodopay website to download the app that helps you manage your financial bills.